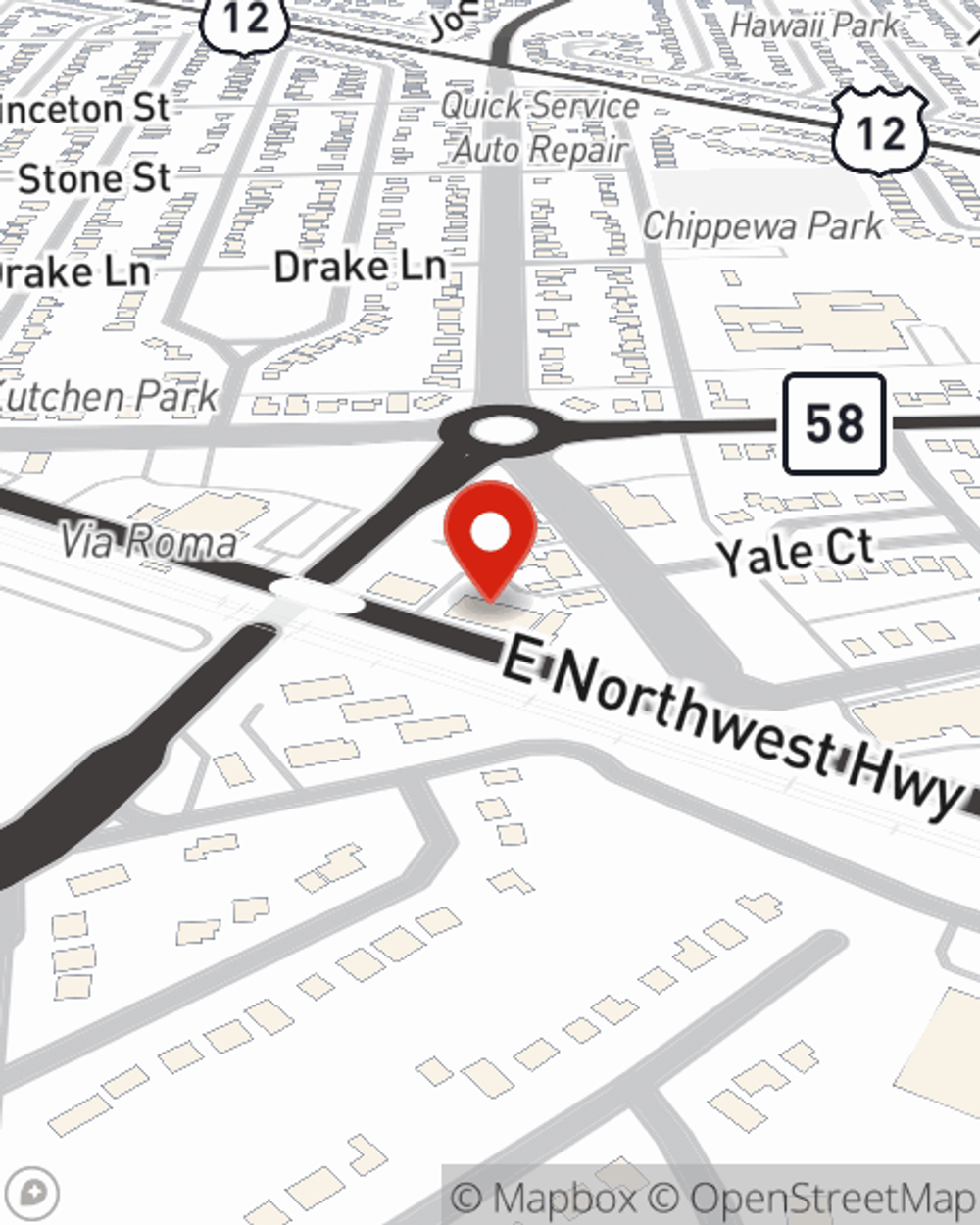

Renters Insurance in and around Des Plaines

Get renters insurance in Des Plaines

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Des Plaines

Insure What You Own While You Lease A Home

There's a lot to think about when it comes to renting a home - location, furnishings, outdoor living space, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Des Plaines

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

When the unexpected accident happens to your rented townhome or apartment, usually it affects your personal belongings, such as a TV, a set of golf clubs or a stereo. That's where your renters insurance comes in. State Farm agent Guy Winters wants to help you choose the right policy so that you can insure your precious valuables.

It's never a bad idea to be prepared. Reach out to State Farm agent Guy Winters for help getting started on savings options for your rented property.

Have More Questions About Renters Insurance?

Call Guy at (847) 699-1300 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Guy Winters

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.